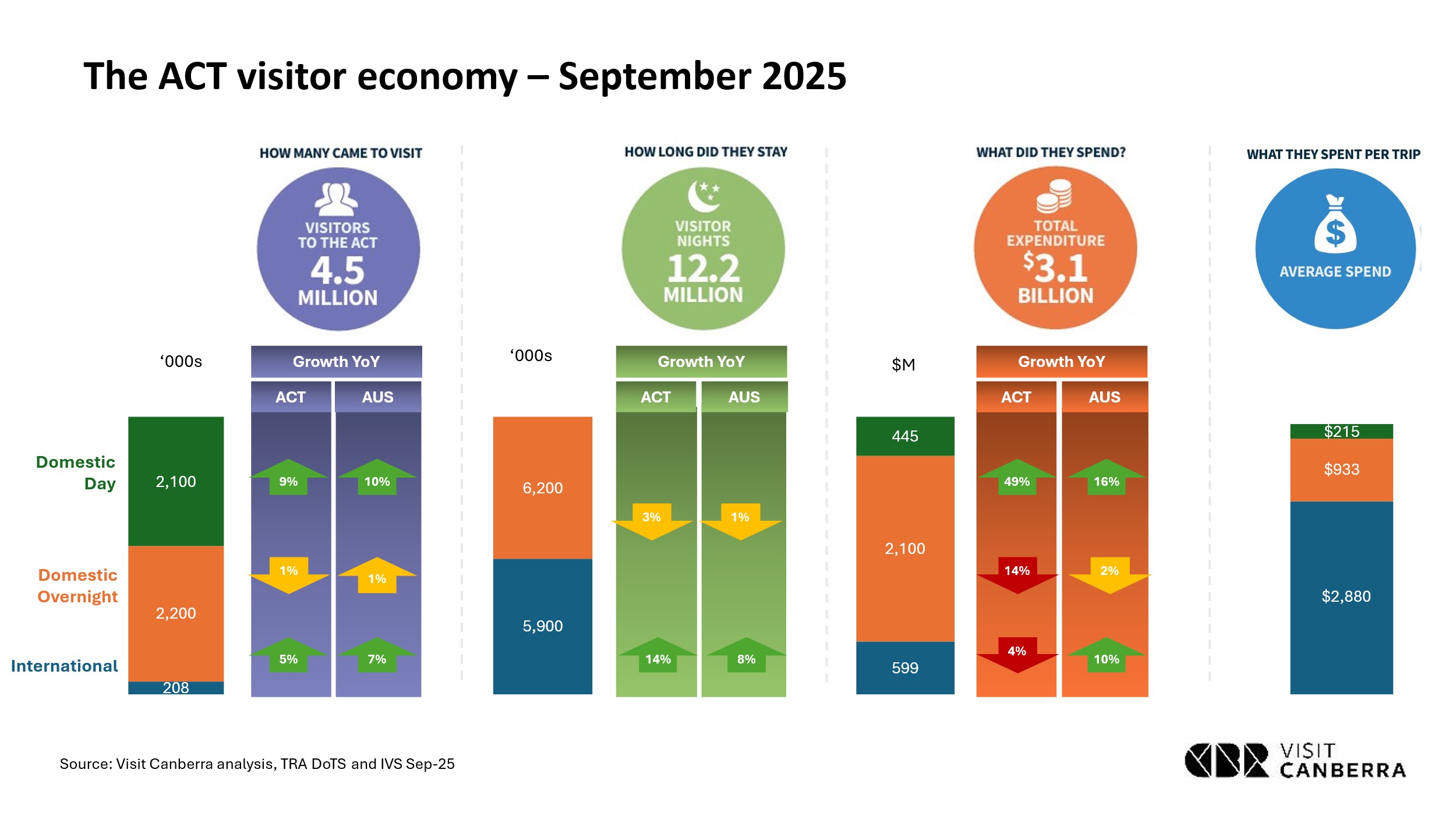

The ACT welcomed 4.5 million visitors for the year ending September 2025, growing 4% year-on-year which is in line with the national trend. Whilst the corresponding visitor spend of $3.1 billion was down 7% year-on-year given some strong reported spend results in 2024, the visitor economy remains on track to achieve the strategic target of $1 billion in growth by 2030.

The latest available visitor economy results for September 2025 show visitation to the ACT continues to grow among Domestic Day and International visitors (up 9% and 5% respectively), whilst Domestic Overnight visitors remain flat.

Key trends among our Domestic and International visitors

Domestic visitors

Domestic overnight visitors are the ACT’s core market, representing 50% of all visitors but 67% of spend. They are the key segment to drive growth.

The key opportunity among industry operators is understanding the visitor motivations for travelling to Canberra – typically holiday, VFR, business – and how to tap these motivations to encourage longer stays or trigger the time to visit. Each of these opportunities play out differently across our source markets:

- Sydney and 3-hour drive – our core source market with highest brand presence and easiest access. The hardest part of the trip decision – to go in the first place – is mostly done for this audience. Focusing on demonstrating value and reward/benefits of a longer stay can help convert day trippers into overnight visitors with a longer list of things to do.

- SE Qld and Rest of Aus – Focus on triggering holiday travel intention specifically, linking with specific events and experiences to create a reason for travel at a specific point in time with a sense of urgency. This market presents opportunities for Bleisure travel by encouraging business travellers (four in 10 of these travellers) to add on holiday nights.

- Melbourne – Holiday, VFR and business travel have equal frequency and value, with each likely to have different triggers at different times. Specific channels can help focus a message to trigger visitation and grow scale through the combination of VFR & Holiday and Business & Holiday (Bleisure travel) to create longer stays.

International visitors

International visitation represents 5% of the ACT Visitor Economy, but 19% of the spend. As a result, an International visitor is 3.1 times more valuable than a Domestic Overnight visitor.

The full mix of travel reasons across markets present both challenges and opportunities for local operators:

- USA – Bleisure travel opportunities, particularly linking to those travelling for VFR which is a key segment visiting Canberra (government, defence contractors, etc). Holiday segment remains a growth opportunity.

- China – Holiday makers represent the largest portion but are not driving local spend, likely due to pre-arranged and booked itineraries. VFR is underperforming relative to other source markets such as India and the US.

- India – High VFR travel incidence leads to focus messaging on what to do with friends and relatives in Canberra – which can target both visitors and hosts.

- UK – incidence of visitation is increasing, potentially impacted by back-to-back British and Irish Lions and Ashes tours, as well as changes to visas for working holiday makers – increasing awareness and consideration for Australia. Seek opportunities to build on this growth to drive intention and booking conversion.

Were you at the launch of Phase 2 of the T2030 ACT Tourism Strategy at the Canberra Region Tourism Advisory Forum in December? If you missed it, or haven’t yet downloaded and read the strategy, then do so here. If you have feedback or questions about the strategy and how it might help your operation, then please get in touch with VisitCanberra at TourismIndustry@act.gov.au.